Human Centered Product Design: A New Approach

It’s not every day you get the chance to rethink an entire suite of Life Insurance products from the ground up. When Will Rogers (our Head of Retail Products) got the chance, he jumped at it. The guiding principles were to create a ‘best-of-breed’ product but with some tweaks that elevate cover with integrity beyond just ‘cutting a cheque’ at claims time.

We sat down with Will to chat about how our Retail products support people financially, physically and mentally – when they need help most.

Thanks for your time Will, first we would like to know a bit about where you focused on improving the customer experience through product design?

My main driver was striving for simplification. For a long time, life insurance products have been extremely complex and hard to understand and in doing this we have created distrust in how we operate and what you may or may not be covered for. Simplification means an easier job for Advisers in explaining products and more comfort for clients in knowing what they’ve got and how they’re protected. Simplification doesn’t mean we took everything out, but we did rationalise everything in our policies to ensure they stood up to clients’ need’s, but we also just made our products easier to digest and used more accessible language throughout our documentation.

Another key focus for us was our benefits and not overloading products with too many options and features (and thus complexity). The great thing about creating modern products was access to data and the wealth of experience of our team which allowed us to stick with benefits we know provide value to clients and avoid features that might sound great but never get claimed.

One of the most thoughtful features (we’re proud of) is the Terminal Illness Care Benefit, can you talk a bit about that and how it works?

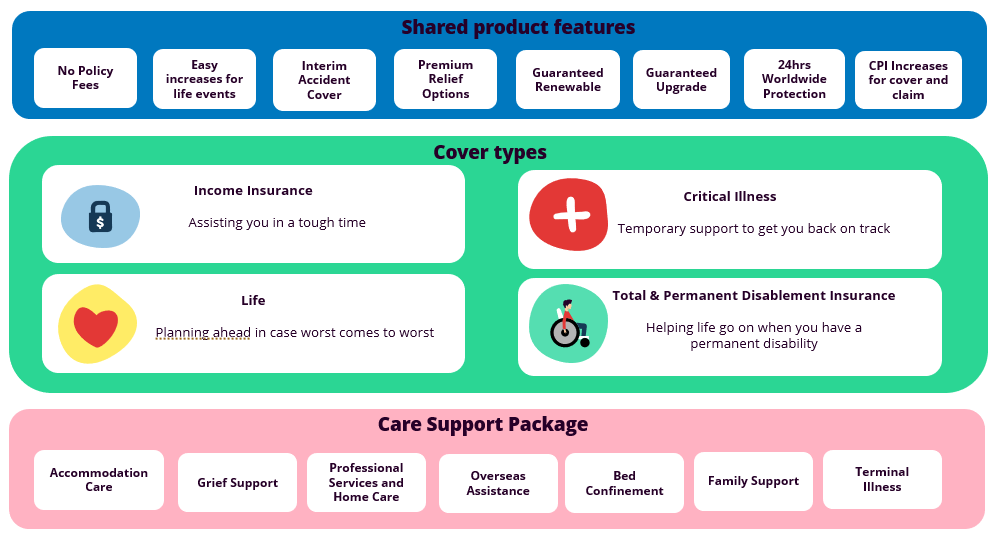

The Terminal Illness Care benefit sits within our market-leading Care Support Package. Our Care Support Package contains a bundle of ancillary benefits which are traditionally found within core life insurance covers. Part of our initial simplification was to pull these ancillary benefits out of the core covers and bring prominence to them for customers.

We also saw the need to build a new type of ancillary benefit, which caters for those customers who are terminally ill and want to die with dignity at home. That’s where our Terminal Illness care benefit comes in. It allows the customer, who’s in their last 30 days, to obtain a benefit where they can choose how to spend it. They may put the benefit to accommodation, medical or other expenses that they are likely to incur during this time.

When designing this feature, we didn’t just pull from our underwriting and industry experience, this was one where personal experience of many of the people who work here was able to inform our approach.

What are some other examples of product features and how they work in real-life?

We know that sometimes when you’re recovering or getting back on your feet, there may be times that there’s a relapse of the condition that you initially suffered. Within our Income Insurance cover, we have an inbuilt feature which restarts an Income Insurance claim if there’s a relapse of the same condition up to 12 months after we stop paying a claim.

When people suffer a critical illness, such as a heart attack or are diagnosed with cancer, unfortunately there’s a strong likelihood that there’ll be a re-occurrence or relapse of the same or a related condition. To ensure our customers are protected when this occurs, we offer the ‘Critical Illness Relapse option’, which is a costed option within our Critical Illness cover. If someone’s cancer spreads to another organ or they suffer another heart attack or even need bypass surgery, the Critical Illness Relapse option will support them at this time.

In everything we do, we start with the principle we were founded on, how can we be there for people when they need it most.

William Rogers

Head of Retail Product

Learn more about our innovative products designed for today’s customer needs.