It pays to think long term.

It’s the ultimate goal – to provide quality advice that not just meets the needs and objectives of clients but supports their financial circumstances and future ambitions.

But what does that mean?

- Understanding the specific financial needs and desires of each client, both today and for the future

- Investigating and then determining which life insurance product(s) would support these needs and desires

- Providing quality advice and a recommendation for the client to make an informed and educated decision

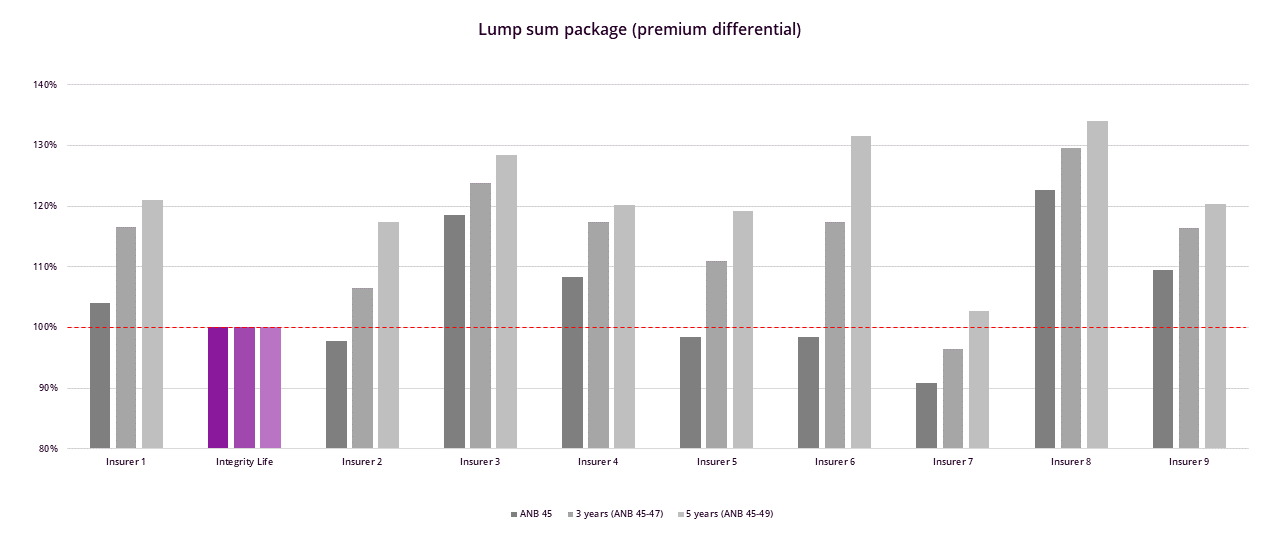

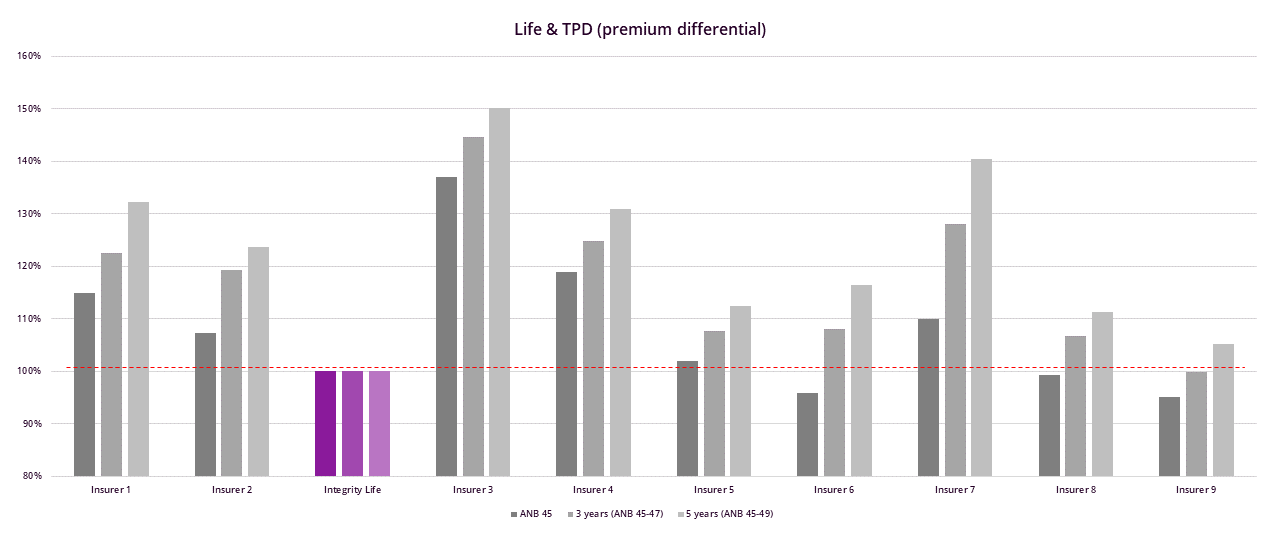

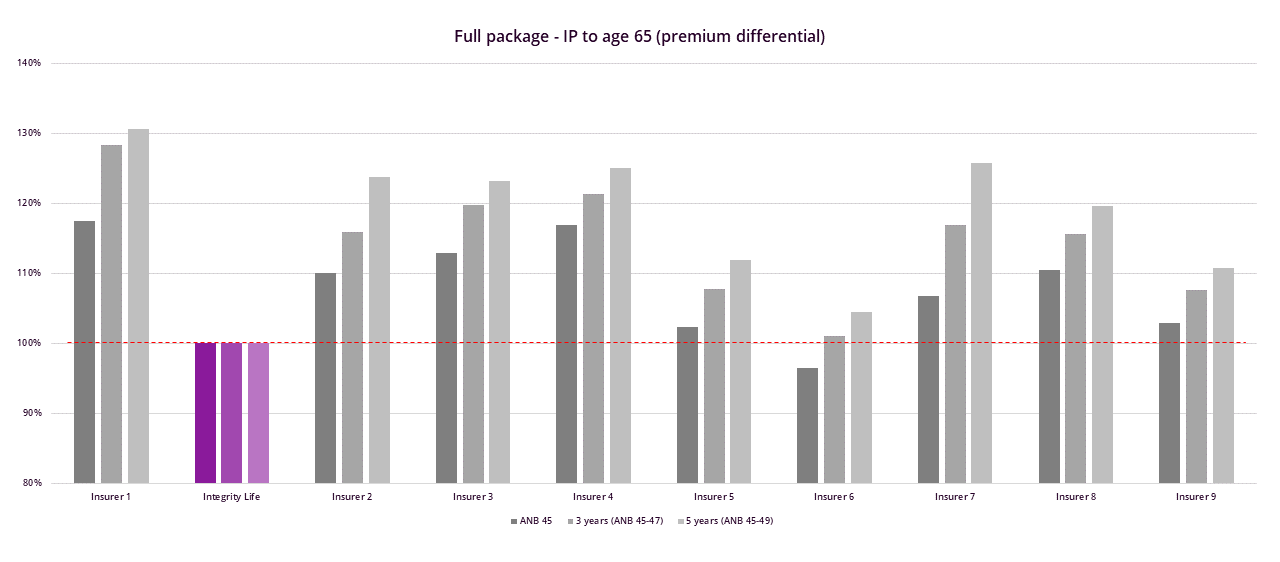

Balancing the cost of delivering to a client’s short and long term needs becomes critical especially in life insurance where cost requires consideration not just for the first year, but also for the third, fifth and maybe even longer.

To understanding the long-term pricing of an insurer it is important to understand an insurer’s ‘sweet spot’ or target market. At Integrity we want to ensure that our insurance is affordable and accessible for the demographic’s that need it most. That’s why we’re focused on the following segments:

- Packages of lump sum covers with and without Income Insurance;

- Clients aged 30-50;

- White and light blue occupations primarily.

We believe life insurance is a product for life, which is why:

- We offer discounts that are for the life of the Policy, such as our 7.5% Multi-Cover Discount and Life+ Healthy Living Discount (10.5% off Life, 5% off TPD and 5% off Critical Illness Cover);

- Our policies have a 2-year rate guarantee;

- We don’t charge archaic monthly premium loadings; and

- Don’t charge Policy fees.

As we’ll show you – it pays to look at insurers over the long term. We’re a standout with cumulative lump sum premium, it’s why we were recognised at Financial Newswire and DEXX&R’s Adviser Choice Risk Awards for our Integrity’s Here for You Critical Illness Cover and Income Insurance Cover, Inside Super and were a finalist for the AFA Life Company of the year Awards in the Trauma category.

Our Integrity’s Here for You product (Life, Income Insurance, TPD and Critical Illness) is tailored to meet the specific needs of this target demographic of client’s, is ranked highly (so you have confidence in our product), definitions that are well placed when compared to other insurers, ancillary benefits that support with the things clients don’t want to be without (their family, a comfortable environment, mental health support and more) and pricing to support clients today, tomorrow and into the long term.

About Integrity Life

So far, we’ve been trusted to protect over 190,000 Australians from all walks of life. We’re committed to being your Partner today, tomorrow and for life. So, what are you waiting for? Go all out and get in contact with the team at Integrity Life at sales@integritylife.com.au for a fresh alternative to the more traditional providers.

Graphs sourced from IRESS as at 11 April 2023.

For full benefit details, terms, conditions and exclusions refer to the Integrity’s Here for You Product Disclosure Statement (PDS). To understand who this product has been designed for refer to the Integrity’s Here for You Target Market Determination (TMD). Both the PDS and TMD are available on our website at www.integritylife.com.au/products/pds-forms