Exclusions While Travelling Home and Abroad

Exclusions While Travelling Home and Abroad

As Australians get ready for the holiday season and families come together from across the globe, domestic and international travel increases. While it may not have occurred to you, this leads insurers to think about the risks associated with travel. To understand the reason for restrictions on locations and the inclusion of war and terrorism exclusions in insurance policies, we need to look to the past. So, let’s go back in time to start at the beginning.

Originally, war exclusions were placed on life insurance policies as a solvency protection measure i.e. to ensure a large event didn’t send an insurer broke! Australia’s population is quite small by world standards, so if a large number of your insured lives went off to armed conflict, and many were killed, then that has a huge impact on the pool of lives – it could lead to life insurers not being able to pay claims. Now, this was relevant when wars were fought by large armies (often volunteers from the civilian population rather than professional soldiers – think of WW1) and pre-dates solvency measures we have today (regulated by APRA).

More recently, a derivative of the war exclusion was developed; the War, Terrorism and Armed Conflict exclusion. The life insurance industry adopted the idea that terrorism risk should be excluded – because many life underwriters got caught up in exaggerated risk perpetuated by politicians and the media. Statistically, you’re more likely to be struck by lightning or drowning in a bathtub than be the victim of a terrorist attack. This is despite Aussie’s being very enthusiastic travellers overseas.

The terrorism exclusion has also now become somewhat outdated, and not just because the incidence of terrorism is so small.

The expectations of the community and Integrity’s view of what is fair and right is that, in the event of a customer being killed by terrorists, we would want to assist the member and pay the claim. Therefore, Integrity Life does not use a terrorism exclusion.

It’s worth acknowledging that general travel risks are managed using the Australian Department of Foreign affairs and Trade travel warnings. Cover will not be offered if the prevailing travel warning is ‘reconsider your need to travel’ or ‘Do not travel’. But as you can imagine, most of the countries falling into these categories are not popular holiday destinations.

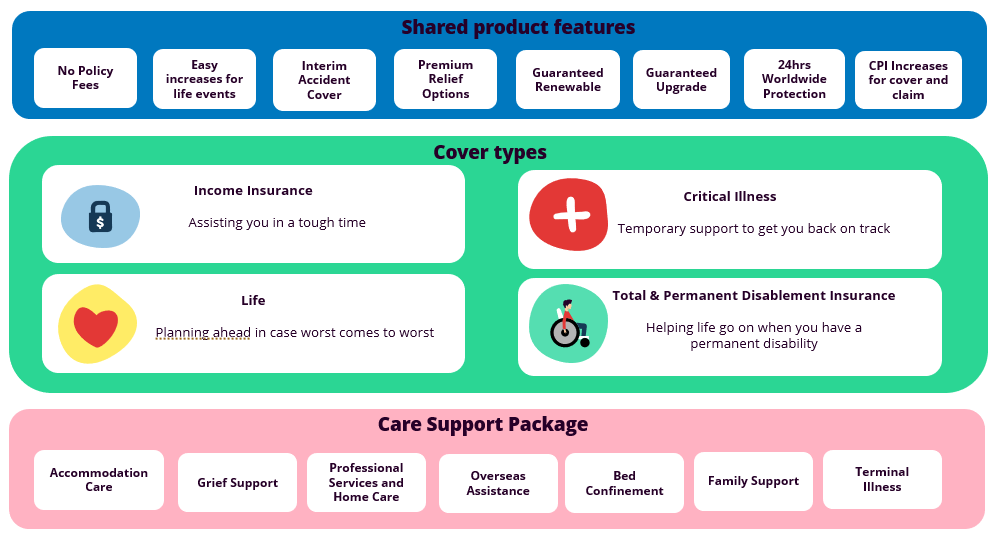

If you’re already insured with Integrity – great! Your policy provides 24/7 coverage worldwide. Plus, if you have our Care Support Package, we can help get you home should you have experience serious injury or illness.

Scott Hodgson

Chief Underwriter