Flexible Insurance Product Design for Real Life

It’s been said that life insurance is ‘sold, not bought’. Partly this is due to the complexity of products but also because human nature is to believe ‘it won’t happen to me’. The key to advisers being able to have meaningful conversations with clients is the mutual understanding that comes from a simple product that is grounded in the real world. The conversation should be about the lived experience not detangling complexity. To better understand how we have approached this challenge, we spoke to Head of Retail Product, William Rogers.

So, Will, could you talk us through how you approached the product design? Where did you start?

Will: When we started to design products, we took the time to undertake detailed customer research to understand what advisers and their clients wanted and where the opportunities were to improve life insurance in Australia.

To bring the product to life, we approached the design with ‘simplicity’ as the key focus. Simplicity leads to greater understanding of the value of a policy and allows advisers to have better, more meaningful conversations with their clients about the life they want to live and not get bogged down in the complexity that is endemic in the life insurance industry.

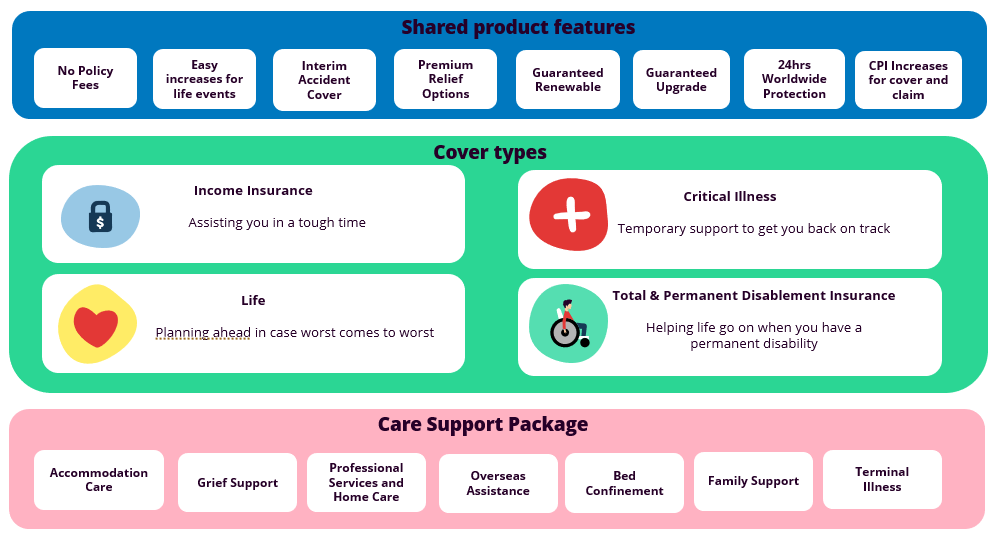

The modular design of our product is simple to look at (pictured below), so while most people would be familiar with the cover types, could you talk us though what you mean by ‘shared product features’?

Will: Good question! The simplicity in product design allowed us to focus on 3 key elements within the product being, Shared product features, 4 core covers and our unique Care Support Package. This focus on the 3 elements delivers a fully featured but simplified retail product.

The shared product features are those elements of an insurance policy that are available on or apply to all core covers.

A few that are worth calling out are features like ‘guaranteed renewable’ and ‘guarantee of upgrade’. This guarantee of upgrade provides policy holders with the certainty that when an enhancement is made to a benefit or medical definition within their policy, we will upgrade their cover to the new standard. Should they claim, we will assess their claim based on the terms at the time of their claim as well as any period of time from when they took out the policy.

We don’t have any policy fees or minimum premium. One of our guiding principles that goes hand-in-hand with simplicity is transparency. The price is the price. We don’t believe in adding fees and service charges on top of the premium.

Cover increases in line with CPI, that is the actual CPI not 5%. This means that for our policies, the actual increase applied for CPI for 2018/19 was 1.6%. This means cover increases at a pace that aligns to what our policy holders are seeing in their life and reduces the risk of over insurance.

Premium relief options. This includes the ability to freeze the annual premium amount which caters for policy owners who see the value of their cover however may be facing financial pressures to retain their cover.

We believe in these brilliant basics that should apply to all our core cover types. By making them standard and grouping them together it keeps our PDS simple and easy to understand.

What is the ‘Care Support Package’ and why is this separate?

Will: The Care Support Package groups 9 benefits which are generally seen as ancillary benefits within IP and lump sum covers into a single package or option that can be linked to a single cover – whether that be income insurance or a lump sum cover. Once you add this to our covers, we believe it becomes superior overall cover while maintaining the simplicity.

Benefits that are included in the Care Support Package include Accommodation Care, Home Care, Grief Counselling and Professional Services benefits.

It also includes a Terminal Illness benefit – which provides a benefit to a life insured in the form of a reimbursement where they have less than 30 days to live. This benefit can be used in the way that they need. This could be to have their family support network around them, in a tent in the middle of Bondi Beach to watch the sun rise or spend these final days in their own home, with their support network of doctors, family and friends close at hand.

It should also be noted that the Care Support Package fee is waived when you take out three covers or more.

William Rogers

Head of Retail Product