You and your clients deserve better. A true partner for life.

You and your clients deserve better. A true partner for life.

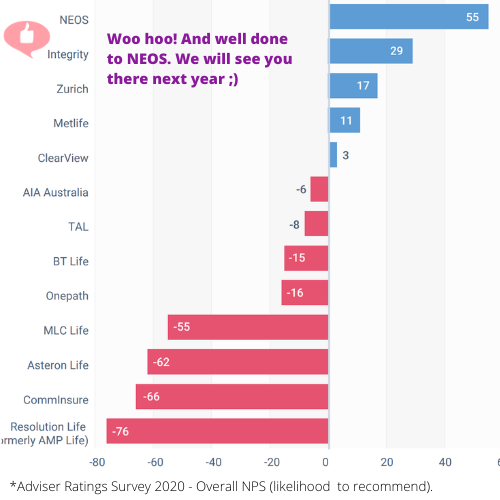

The latest Adviser Ratings survey has been released and it’s not great news for some large, established insurers. The 2020 survey shows that Advisers are deeply unhappy with the service levels and support they’re receiving. This continues to trend downwards from 2019… despite lots of feedback from the industry. The message from these large, established insurers to advisers is pretty clear. If it were a romantic relationship they are saying “We’re just not that into you.”

Time to break-up?

Why stay trapped in an unhappy relationship when you have choice? Perhaps it is time to break up. Integrity Life brings no baggage to a new relationship. We are digitally enabled and legacy free. We are very proud to be on the podium and ranked second in the industry for adviser advocacy in the latest Adviser Ratings Survey for:

- Ease in underwriting

- Platform functionality

- Insurer competitiveness

- Adviser support and

- Overall NPS (pictured).

In addition to that, we got the highest rating on the charts for both ‘New Adviser Support’ and ‘Easy to understand documentation’ which are two areas we know are important to Advisers.

As the ‘new kid on the block’ we’re really happy with these results and it’s an achievement we couldn’t have made without the support and feedback from Advisers. We have always believed that listening, learning and then acting on Adviser feedback would be the secret to success, so to have this validated by the largest industry survey of its kind is absolutely wonderful!

On behalf of Integrity, I would like to thank all the Advisers who have taken the time to provide their feedback through the Adviser Ratings survey. I hope that over the last 2+ years, Integrity has demonstrated a commitment to co-creating the kinds of product and service models that support Advisers in the ways they need to deliver the best outcomes for their clients.

What your business needs is more of you. So, let’s free up your time.

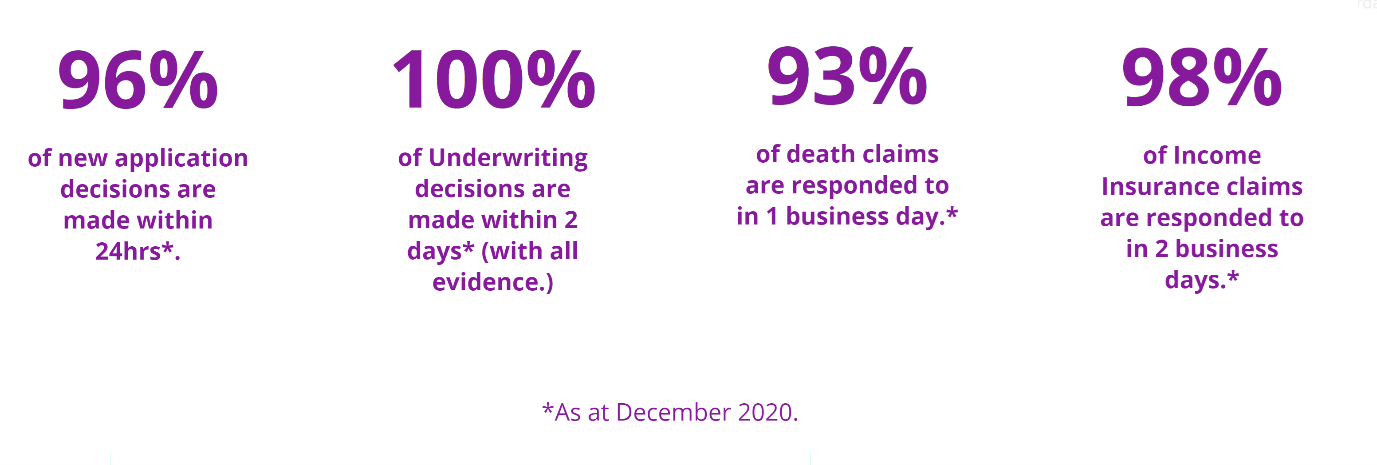

Our focus for 2021 is to continue to drive efficiency in how we do business and how we work with Advisers, partners and their clients. It’s not just so that you’re not spending time ‘dealing with us’, we also want to support you in having easier client interactions, simplified compliance, and help you manage renewals. We believe that’s what Advisers need.

Maybe it’s time for you to see other people?

We would love to get to know you better and you should know, we’ve been working hard on ourselves. So, if you haven’t had a look at Integrity for a while there have been some big improvements you may not be across.

One of our most recent product updates included enhancements and changes that Advisers requested, with more to follow later in the year. Integrity’s retail products are now more flexible and easier to compare and with additional included value and features. Plus, all this was delivered without any changes to pricing (something Advisers also asked for!) You can read more about this significant update here.

There have also been a lot of positive changes to improve the application and underwriting process – making it even smoother. Examples include the new paramedical provider panel and Application Concierge – which is speeding up the applications with great initial results.

Got an idea or feedback?

We would love to hear from you. Integrity is committed to being the best ‘partner for life’ and that starts with listening. Please get in contact via this form or pick up the phone and we can arrange a time to chat.

We’re looking forward to delivering even better results with your support – and of course, your invaluable feedback.

If you would like to learn more about what else we’re up to, I invite you to see how Integrity is the perfect partner – for life!

Sean McCormack

Managing Director and CEO